Thinking About Learning About Home Mortgages? Read This

Content by-Thaysen Fuller

Getting a great deal on your home mortgages is not easy. Paying it off in a timely manner also takes quite a bit of work. Doing your research before you sign the mortgage papers is your best bet. Follow the helpful home mortgage tips listed below to make sure you have the upper hand when signing the papers for a home mortgage.

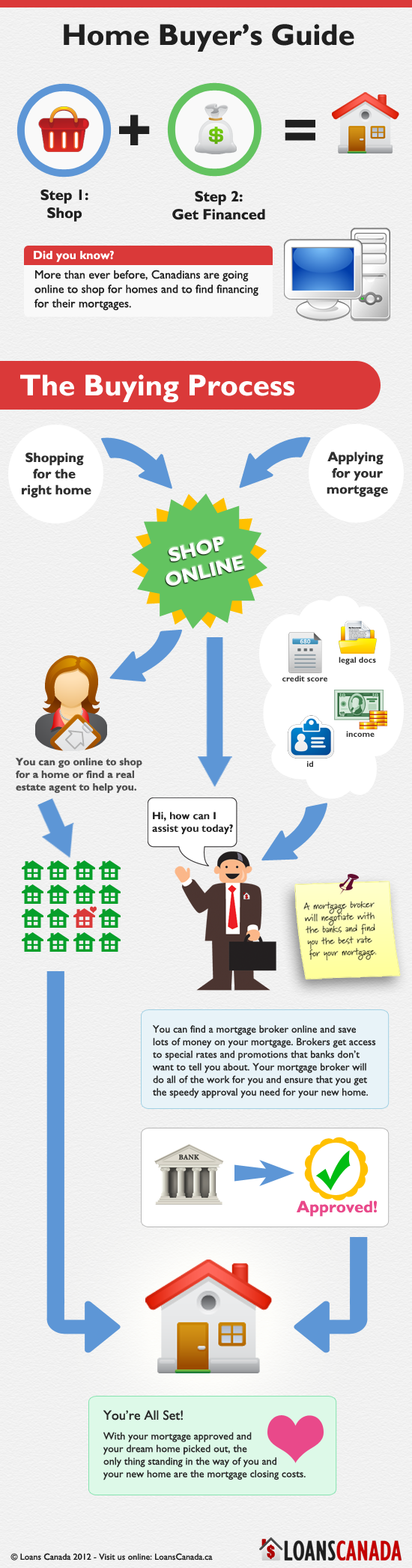

Once you have chosen the right loan for your needs and begun the application process, make sure to get all of the required paperwork in quickly. Ask for deadlines in writing from you lender and submit your financial information on time. Not submitting your paperwork on time may mean the loss of a good interest rate.

Remember that the interest rate isn't the most important part of a mortgage. You also have to think about closing costs, points and other incidentals. There are different kinds of loan as well. That is why you have to find out as much as you can about what you're eligible for.

Set your terms before you apply for a home mortgage, not only to prove that you have the capacity to pay your obligations, but also to set up a stable monthly budget. This means establishing a limit for your monthly payment, based on what your income allows, not only for what kind of house you are looking for. If you take on more house than you can afford, you will have real problems in the future.

Try shopping around for a home mortgage. When you do shop around, you need to do more than just compare interest rates. While they're important, you need to consider closing costs, points and the different types of loans. Try getting estimates from a few banks and mortgage brokers before deciding the best combination for your situation.

When you decide to apply for a mortgage, make sure you shop around. Before deciding on the best option for you, get estimates from three different mortgage brokers and banks. Although, interest rates are important, there are other things you should consider also such as closing costs, points and types of loans.

Know your mortgage interest rate type. When you are obtaining home financing you should understand how the interest is calculated. Your rate could be fixed or it could be adjustable. With fixed interest rates, your payment will usually not change. Adjustable rates vary depending on the flow of the market and are variable.

There are several good government programs designed to assist first time homebuyers. They have programs that offer help to those with bad credit, and they can often help negotiate a more favorable interest rate.

Look over you real estate settlement statement before signing any papers. Your mortgage broker is required by law to show how all the monies are dispersed at the closing. If the seller has agreed to pay for some of the closing costs, ensure that this is noted on the settlement statement.

If you are having problems paying your home mortgage, contact your lender immediately. Don't ignore the problem. That'll only make the issue worse. Your lender can show you many different options that may be available to you. They can help you keep your home by making the costs more affordable.

Choose your mortgage lender many months in advance to your actual home buy. Buying a home is a stressful thing. There are a lot of moving pieces. If you already know who your mortgage lender will be, that's one less thing to worry about once you've found the home of your dreams.

Current interest rates on home mortgages are lower than they have been in years. Experts expect them to begin increasing again shortly, so now is a great time to purchase a home and finance it at a low rate. The shorter the term of the mortgage, the better the rate you will be able to get.

An adjustable rate mortgage won't expire when its term ends. However, the rate does get adjusted to the current rate at that time. This means the mortgage could have a higher interest rate.

You may want to consider refinancing your home mortgage. Interest rates have gone down a great deal in recent years, and due to this you could pay thousands less over the term of your loan if you refinance now. This is something that you must consider if you are pay just a fraction of a percent more than what you could pay now.

Do not change financial institutions or move any money while you are in the process of getting a loan approved. If there are large deposits and/or money is being moved around a lot, the lender will have a lot of questions about that. If you don't have a solid reason for it, you may end up getting your loan denied.

Many computers have built in programs that will calculate payments and interest for a loan. Use the program to determine how much total interest your mortgage rate will cost, and also compare the cost for loans with different terms. You may choose a shorter term loan when you realize how much interest you could save.

Make sure you have a large down payment saved up. It is always better to put a larger sum down when you get a home mortgage. The more money you have to put down on your house, the lower your payments will be in the future. link web site means more spending money each month.

If you have previously been a renter where maintenance was included in the rent, remember to include it in your budget calculations as a homeowner. A good rule of thumb is to dedicate one, two or even three perecent of the home's market value annually towards maintenance. This should be enough to keep the home up over time.

Making sure you have multiple income streams is important when seeking out a home mortgage. If you can find a roommate, take a second job, or make sure your partner or spouse has a solid income, this will definitely work well in your favor. Applying with multiple streams of income is something that makes mortgage lenders drool.

With the tips that have been provided, you're definitely more aware now of what it takes to secure a good mortgage. So, get out there and start looking, taking with you what you've learned. There is no excuse to end up wishing you hadn't signed your mortgage documents because you now know what to do.