How To Secure Yourself From Authorizing A Bad Mortgage Contract

Article created by-TRUE Odom

Are you getting ready to purchase your first home? Are you already a homeowner who is looking for a better deal on your mortgage? If so, there is always more to learn about getting a great deal on your mortgage. Use the tips below to get a mortgage plan that is fair for you.

To make sure that you get the best rate on your mortgage, examine your credit rating report carefully. Lenders will make you an offer based on your credit score, so if there are any problems on your credit report, make sure to resolve them before you shop for a mortgage.

Avoid fudging the numbers on your loan application. It is not unusual for people to consider exaggerating their salary and other sources of income to qualify for a larger home loan. Unfortunately, this is considered froud. You can actually be criminally prosecuted, even though it doesn't seem like a big deal.

Watch out for banks offering a "no cost" mortgage loan. There is really no such thing as "no cost". The closing costs with "no cost" mortgages is rolled into the mortgage loan instead of being due upfront. This means that you will be paying interest on the closing costs.

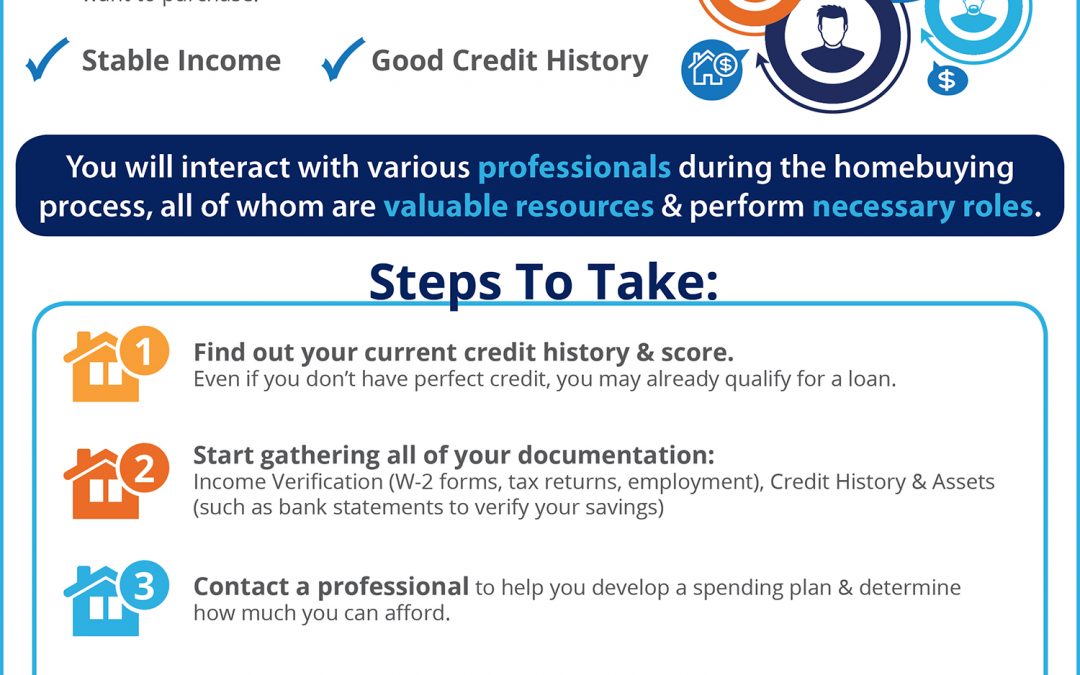

Having the correct documentation is important before applying for a home mortgage. Before speaking to a lender, you'll want to have bank statements, income tax returns and W-2s, and at least your last two paycheck stubs. If you can, prepare these documents in electronic format for easy and quick transmission to the lender.

If you find that your home's value has sunk below the amount you still have left on the mortgage, and have unsuccessfully tried to refinance in the past, give it another try. HARP is allowing homeowners to refinance regardless of how bad their situation currently is. Speak with the lender you have to see if you can do anything with a HARP refinance. If the lender will not work with you, make sure you find someone else who will.

Make a budget to define exactly how much you are willing to pay each month towards your mortgage. This means limiting your monthly payments to an amount you can afford, not just based on the house you want. Keep yourself out of financial trouble by buying a house you can afford.

Be sure to keep all payments current when you are in the process of getting a mortgage loan. If you are in the middle of the loan approval process and there is some indication that you have been delinquent with any payments, it may affect your loan status in a negative way.

If you're having trouble paying off your mortgage, get help. Look into counseling if you are having trouble keeping up with your payments. HUD-approved counselors exist in most regions. With assistance from counselors that are HUD approved, free counseling can be had that helps with preventing foreclosures. To find a counselor in your area, check the HUD website or call them yourself.

If your mortgage is causing you to struggle, then find assistance. There are a lot of credit counselors out there. Make sure you pick a reputable one. There are government programs in the US designed to help troubled borrowers through HUD. By using HUD approved counselors, your chances of going into foreclosure are lower. Go online to the HUD website or give them a call to locate an office near you.

If you have previously been a renter where maintenance was included in the rent, remember to include it in your budget calculations as a homeowner. A good rule of thumb is to dedicate one, two or even three perecent of the home's market value annually towards maintenance. This should be enough to keep the home up over time.

Do your homework about any potential mortgage lenders before you sign an official contract with them. Do https://www.cnbc.com/2021/06/14/small-business-bank-account-american-express-puts-kabbage-acquisition-to-work-with-first-checking-account.html take a lender at their word. Ask around for information. Look https://www.forbes.com/sites/forbesbusinesscouncil/2021/02/26/five-banking-customer-experience-tips-to-improve-digital-transformation/ up on the Interenet. Contact the BBB to find out more about the company. You must get a loan with a lot of knowledge behind you so that you're able to save a lot of money.

Shop around for mortgage refinancing once in a while. Even if you get a great deal to start with, you don't want to set it and forget it for several decades. Revisit the mortgage market every few years and see if a refinance could save you money based on updated insurance rates.

While you are in the process of getting a mortgage loan, do not apply for any new credit cards. Every time your credit is checked it puts a mark on your credit score. Too many of these will make it difficult on you if your credit is already a bit questionable.

Many lenders now require a home to be inspected before the loan is approved. Although this costs a small amount of money, it can save you thousands in unknown expenses. If the home inspector finds problems with the home, you have the opportunity to either negate the contract or to renegotiate the sales price.

Keep your credit score as high as possible. Request a copy of your credit report from all three credit reporting agencies, and check to make sure it is accurate. Banks typically don't approve anyone with a score of less than 620 today.

During your application for a home loan, get a rate-lock. A rate-lock in writing guarantees certain terms and interest rates for a given period of time. Set the rate-lock "on application" instead of "on approval". The lock-in period needs to be long enough to allow for factors that can delay the loan process.

If you are a retired person in the process of getting a mortgage, get a 30 year fixed loan if possible. Even though your home may never be paid off in your lifetime, your payments will be lower. Since you will be living on a fixed income, it is important that your payments stay as low as possible and do not change.

Investigate preapprovals before you start home shopping. Preapproved mortgages will give you an idea of both how much home you can afford plus what your monthly mortgage payments will be. This will set the parameters of your home shopping and save you time not looking at properties you can't realistically afford.

So many individuals all over the world are in search of a home mortgage only to see their application get denied. This does not have to be you, and the tips that you just read have simplified everything. Use them wisely to help you prepare yourself to get approved for a home mortgage.